Guide for Technical Analysis in Binary Options Trading

Embarking on the exciting journey of binary options trading opens up a world of potential and opportunities. To navigate this dynamic market successfully, it is crucial to have a comprehensive understanding of technical analysis. By using various tools and techniques, traders can make informed predictions about the future movements of assets and make profitable trades.

At the heart of technical analysis lies the chart, a visual representation of an asset’s price activity over a specific period. By analyzing these charts, traders can identify patterns, trends, and indicators that provide valuable insights into market behavior. Technical analysis looks beyond the noise and focuses on the underlying factors driving price movements, enabling traders to make more informed decisions.

These charts serve as a window into the market, offering a glimpse into the past and present activity of an asset. By studying historical price data and patterns, traders can identify potential opportunities and make predictions about future price movements. Technical analysis is a skill that can be honed over time, allowing traders to develop a keen eye for spotting trends and patterns that others may overlook.

Understanding Technical Analysis and Its Significance in Binary Options Trading

Technical analysis involves the study of historical price data and the use of charts to identify patterns and trends in market activity. By examining these patterns, traders can gain insights into the future direction of an asset’s price and make predictions about its future movements.

One of the key components of technical analysis is the use of charts. These visual representations of price data provide a comprehensive view of an asset’s historical performance, allowing traders to identify patterns and trends that can be used to predict future price movements.

By studying these charts and recognizing specific patterns, traders can identify potential trading opportunities. For example, if a chart shows a recurring pattern of price increases followed by a period of consolidation, a trader may anticipate a future price breakout and enter a trade accordingly.

Technical analysis also involves the use of various technical indicators, such as moving averages, oscillators, and trend lines, to further analyze market trends and confirm trading signals. These indicators provide additional insights into an asset’s price movements and can help traders make more informed decisions.

By using charts, analyzing patterns, and utilizing technical indicators, traders can gain a deeper understanding of market trends and make more accurate predictions about future price movements.

The Fundamental Principles and Concepts of Technical Analysis

Understanding the fundamental principles and concepts of technical analysis is crucial for successful trading in binary options. By analyzing the market activity and movements of various assets, traders can make predictions about future price movements and identify potential trading opportunities.

Technical analysis involves the use of various tools and techniques to analyze historical price data and identify patterns that can be used to make informed trading decisions. These patterns can provide valuable insights into the potential direction of an asset’s price, helping traders to identify opportunities for profitable trades.

One of the key principles of technical analysis is the belief that market prices are influenced by supply and demand factors, and that these factors can be identified and analyzed through the use of technical indicators. By examining these indicators, traders can gain a better understanding of market trends and make more accurate predictions about future price movements.

Technical analysis also looks at the concept of support and resistance levels, which are price levels where an asset’s price has historically had difficulty moving beyond. These levels can act as barriers to price movements and can be used to identify potential entry and exit points for trades.

Another important concept in technical analysis is the idea of trend analysis. By analyzing the overall direction of an asset’s price movement, traders can determine whether the asset is in an uptrend, a downtrend, or a sideways trend. This information can be used to make more informed trading decisions and increase the potential for profitable trades.

Common Tools and Indicators for Analyzing Binary Options Trading

When it comes to analyzing binary options trading, there are several common technical analysis tools and indicators that can be used to identify patterns and predict market movements. By using these tools effectively, traders can uncover potential opportunities and make informed decisions about their assets.

One of the most commonly used tools is the chart, which provides a visual representation of an asset’s price movements over a specified period of time. Traders can analyze these charts to identify patterns that may indicate future market activity. By studying these patterns, traders can make predictions about the potential direction of an asset’s price.

Another important tool is the use of technical indicators. These indicators are mathematical calculations based on an asset’s price and/or volume data. They are used to analyze market trends and provide insights into potential market reversals or continuations. By using technical indicators, traders can gain a deeper understanding of an asset’s potential movement.

Some commonly used technical indicators include moving averages, which smooth out price data and help identify trends; oscillators, which measure the momentum of price movements; and support and resistance levels, which indicate price levels at which an asset is likely to encounter buying or selling pressure.

| Technical Indicator | Description |

|---|---|

| Moving Averages | Smooth out price data and identify trends |

| Oscillators | Measure the momentum of price movements |

| Support and Resistance Levels | Indicate price levels of buying or selling pressure |

By using these common technical analysis tools and indicators, traders can enhance their ability to predict market movements and make informed decisions about their binary options trading.

Understanding Candlestick Charts: Analyzing Price Movements in Technical Analysis

In the world of binary options trading, being able to accurately interpret candlestick charts is crucial. These charts provide valuable insights into the market’s activity and can help identify potential trading opportunities. By using candlestick charts, traders can analyze the price movements of an asset and make informed decisions based on patterns and trends.

What are Candlestick Charts?

Candlestick charts are a popular tool used in technical analysis to visualize price movements over a specific time period. They display the opening, closing, high, and low prices of an asset, represented by rectangular shapes called “candles.” The color of the candle can indicate whether the price has increased or decreased during that period, with green or white candles typically representing bullish movements and red or black candles indicating bearish movements.

Interpreting Candlestick Patterns

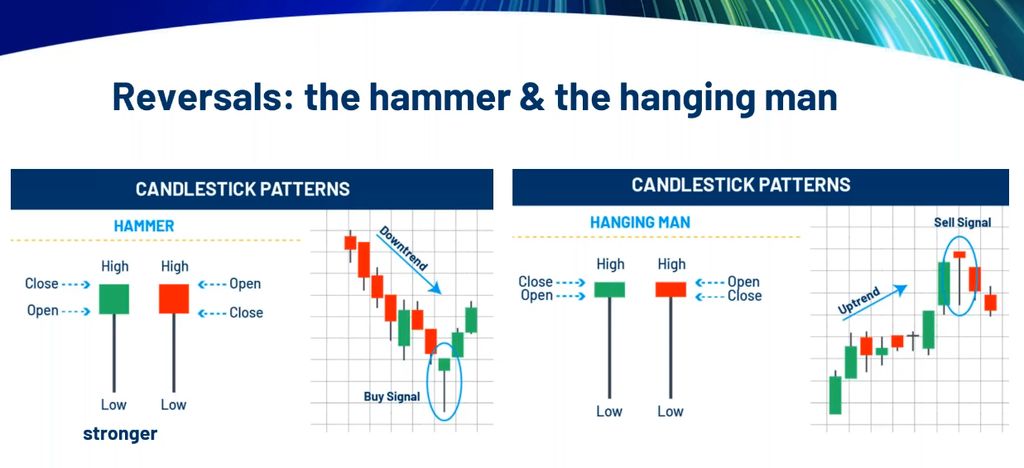

By examining the different patterns formed by candlesticks, traders can gain insights into the market’s behavior and predict potential future price movements. Some common candlestick patterns include doji, hammer, shooting star, engulfing, and spinning top. Each pattern has its own significance and can provide valuable information about the market sentiment and potential reversals.

| Pattern | Description |

|---|---|

| Doji | A candle with a small body, indicating indecision between buyers and sellers. |

| Hammer | A candle with a small body and a long lower shadow, suggesting a potential bullish reversal. |

| Shooting Star | A candle with a small body and a long upper shadow, signaling a potential bearish reversal. |

| Engulfing | A two-candle pattern where the second candle completely engulfs the first, indicating a reversal in the opposite direction. |

| Spinning Top | A candle with a small body and long upper and lower shadows, suggesting indecision in the market. |

Using Support and Resistance Levels in Technical Analysis for Binary Options Trading

Support and resistance levels are essential tools in technical analysis for binary options trading. These levels are significant price levels that can help traders identify potential patterns and make predictions about future price movements of an asset. By analyzing the market activity and identifying these key levels, traders can find opportunities to enter profitable trades.

Support levels are price levels where the demand for an asset is strong enough to prevent it from falling further. These levels act as a floor and provide a potential buying opportunity. Resistance levels, on the other hand, are price levels where the supply of an asset is strong enough to prevent it from rising further. These levels act as a ceiling and provide a potential selling opportunity.

Traders can use support and resistance levels to make predictions about the future price movements of an asset. When an asset’s price approaches a support level, it is likely to bounce back up, creating a potential buying opportunity. Conversely, when an asset’s price approaches a resistance level, it is likely to reverse and move downwards, creating a potential selling opportunity.

Support and resistance levels can be identified using various technical analysis tools and indicators. Traders can use trend lines, moving averages, Fibonacci retracements, and other tools to draw these levels on price charts. By analyzing historical price data and identifying these levels, traders can gain insights into the potential future price movements of an asset.

Support and resistance levels can also be used to confirm the validity of other technical analysis patterns. For example, if a bullish reversal pattern forms near a strong support level, it provides additional confirmation that the pattern is reliable and increases the trader’s confidence in their prediction. Similarly, if a bearish reversal pattern forms near a strong resistance level, it strengthens the trader’s belief that the asset’s price will continue to decline.

Applying Technical Analysis Strategies to Make Informed Trading Decisions

One effective approach to achieve this is by applying technical analysis strategies. By using various tools and techniques, traders can analyze the past price movements of an asset and make predictions about its future behavior. This section will explore the different technical analysis strategies that can be used to identify trading opportunities and maximize potential profits.

Identifying Patterns and Trends

One of the key aspects of technical analysis is identifying patterns and trends in the market. Traders can look at historical price data represented on a chart to identify recurring patterns that indicate potential future price movements. By recognizing these patterns, traders can make informed decisions about when to enter or exit trades.

Additionally, analyzing trends can help traders understand the overall market sentiment and direction. By studying the market’s activity, traders can determine whether an asset is experiencing an uptrend, a downtrend, or moving sideways. This information can be used to make predictions and adjust trading strategies accordingly.

Using Indicators and Oscillators

Technical analysis also involves using indicators and oscillators to gain further insights into market behavior. These tools provide additional information about an asset’s price movements and can help traders make more accurate predictions.

Indicators, such as moving averages, can be used to smooth out price data and identify the overall trend. They can help traders determine whether an asset is in an uptrend or a downtrend, providing valuable information for making trading decisions.

Oscillators, on the other hand, measure the momentum and overbought/oversold conditions of an asset. They can indicate potential reversal points or identify when an asset is overbought or oversold. By using oscillators in conjunction with other technical analysis tools, traders can make more informed decisions about when to enter or exit trades.

| Technical Analysis Strategies | Description |

|---|---|

| Support and Resistance Levels | Identifying key levels where an asset’s price is likely to reverse or stall |

| Chart Patterns | Recognizing recurring patterns on price charts that indicate potential future price movements |

| Fibonacci Retracement | Using Fibonacci ratios to identify potential support and resistance levels |

| Candlestick Patterns | Interpreting the shapes and formations of candlestick patterns to predict future price movements |

FAQ:

What is technical analysis in binary options trading?

Technical analysis in binary options trading refers to the process of using historical price data, chart patterns, and indicators to predict future price movements. It involves analyzing market trends, identifying support and resistance levels, and making trading decisions based on these patterns.

Why is technical analysis important in binary options trading?

Technical analysis is important in binary options trading as it helps traders make informed decisions by analyzing past price data and identifying potential trends. It can provide insights into market sentiment, help determine entry and exit points, and improve the overall accuracy of trading predictions.

What are some commonly used technical indicators in binary options trading?

Some commonly used technical indicators in binary options trading include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger Bands. These indicators help traders identify overbought or oversold conditions, trend reversals, and potential entry or exit points.

How can beginners get started with technical analysis in binary options trading?

Beginners can start with technical analysis in binary options trading by learning the basics of chart analysis, understanding different types of indicators, and practicing on demo accounts. They can also explore educational resources, attend webinars, and seek guidance from experienced traders to improve their technical analysis skills.

Is technical analysis the only factor to consider in binary options trading?

No, technical analysis is just one aspect of binary options trading. Fundamental analysis, which involves evaluating economic indicators, news events, and company financials, is also important. Traders should consider a combination of technical and fundamental analysis to make well-informed trading decisions.