10 Options Strategies Every Beginner Should Know

Let’s look at the first strategy on our list: the covered call. This strategy involves purchasing shares of a stock and simultaneously selling call options against those shares. By doing so, the investor generates income from the sale of the options, which can offset the cost of purchasing the shares.

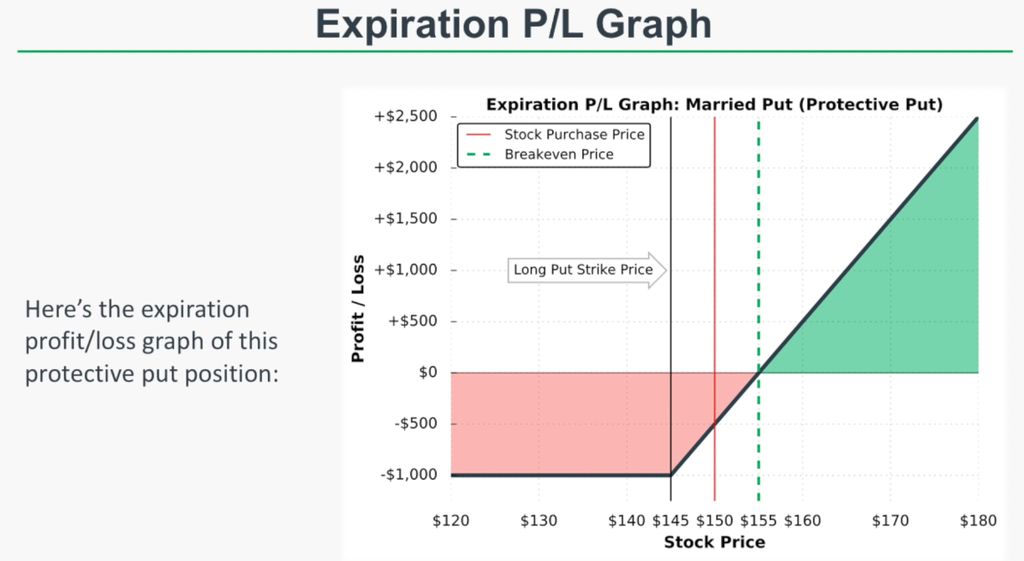

The second strategy on our list is the protective put. This strategy is used to protect against potential losses in a long stock position. By purchasing a put option on the underlying stock, the investor has the right to sell the stock at a predetermined price, known as the strike price.

If the stock’s price declines, the put option will increase in value, offsetting the losses in the stock position. This strategy is often used by investors who want to limit their downside risk while still participating in potential gains.

Covered Call: A Protective Strategy for Options Trading

A covered call is a strategy used by traders to generate income while also providing a certain level of protection. It involves selling call options on a stock that the trader already owns, hence the term “covered.” By selling these calls, the trader earns a premium, which can offset any potential losses in the stock’s value.

When executing a covered call, the trader sells a call option with a strike price above the current market price of the underlying stock. This means that if the stock price rises above the strike price, the call option may be exercised by the buyer, resulting in the trader having to sell their shares at the strike price.

The key idea behind a covered call is to generate income from the premium received while still maintaining ownership of the stock. This strategy is often used by investors who have a neutral to slightly bullish outlook on the stock’s future performance.

One of the main advantages of a covered call strategy is that it allows traders to reduce their cost basis in the stock. By selling the call option, the trader effectively lowers the amount they paid for the stock, making it more cost-effective to hold long-term.

It’s important to note that a covered call strategy does have limitations. If the stock price increases significantly, the trader may miss out on potential gains as their shares will be sold at the strike price. Additionally, if the stock price declines, the premium earned from selling the call may not fully offset the losses.

Married Put: A Protective Strategy for Bearish Market Conditions

One of the main advantages of the married put strategy is that it provides a level of protection for the investor’s stock holdings. By buying put options, the investor has the right to sell the underlying stock at a predetermined strike price, regardless of how low the stock price may fall. This protects the investor from significant losses in case the stock price drops below the strike price.

The married put strategy involves buying both the underlying stock and put options. The investor buys shares of the stock and simultaneously buys put options with a strike price below the current stock price. This creates a protective spread, as the put options offset any potential losses in the stock position.

When executing the married put strategy, it is important to consider the number of contracts to be bought. The number of put options should be made greater than the number of stocks owned, as each put option contract typically covers 100 shares of the underlying stock. This ensures that the protective spread adequately covers the stock position.

The married put strategy is similar to another options strategy known as the protective put strategy. Both strategies involve buying put options to protect stock positions. However, the main difference lies in the timing of the trades. In the married put strategy, the stock and put options are bought at the same time, while in the protective put strategy, the put options are bought after the stock is already owned.

Bull Call Spread: A Profitable Strategy for Bullish Investors

The Bull Call Spread involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price. This trade-off between buying and selling options creates a spread, which limits the maximum profit that can be made but also reduces the potential losses.

By using the Bull Call Spread, investors are able to generate income from the sale of the higher strike call option, which helps offset the cost of buying the lower strike call option. This strategy is particularly useful when the investor believes that the stock price will rise but does not expect a significant increase.

The key advantage of the Bull Call Spread is that it allows investors to participate in a bullish market while limiting their risk. The maximum profit potential is achieved when the stock settles at or above the strike price of the higher call option at expiration. On the other hand, the maximum loss is limited to the initial cost of the trade.

Bear Put Spread: A Strategy for Profitable Options Trading

When it comes to options trading, there are various strategies that investors can employ to generate profits. One such strategy is the Bear Put Spread, which involves purchasing put options while also selling put options at a lower strike price. This strategy is often used by traders who have a bearish outlook on a particular stock or asset.

How does the Bear Put Spread work?

In a Bear Put Spread, the investor buys a put option with a higher strike price and simultaneously sells a put option with a lower strike price. By doing so, they create a spread that allows them to profit if the stock price decreases. The maximum profit that can be achieved with this strategy is the difference between the strike prices, minus the net premium spent on the options.

Why use the Bear Put Spread?

The Bear Put Spread is a popular strategy because it allows investors to limit their downside risk while still potentially making a profit. By selling a put option at a lower strike price, the investor reduces the cost of purchasing the higher strike put option. This reduces the overall risk and increases the potential for profit.

- The Bear Put Spread is a strategy used by bearish investors.

- It involves buying a put option and selling a put option with different strike prices.

- The maximum profit is the difference between the strike prices, minus the net premium spent.

- The Bear Put Spread allows for limited downside risk and potential profit.

Protective Collar: A Strategy to Safeguard Your Investments

Protective Collar, designed to limit potential losses while still providing the opportunity for gains.

The Protective Collar strategy involves purchasing a put option to protect against a decline in the price of an underlying asset, while simultaneously selling a call option to generate income. By doing so, the investor creates a “collar” around their position, which limits both the upside and downside potential of the trade.

- Purchasing Protective Puts: The trader buys put options, which give them the right to sell the underlying asset at a predetermined price (known as the strike price) before a specified date (known as the expiration date). This provides downside protection in case the asset’s price declines.

- Selling Covered Calls: The trader sells call options, which obligate them to sell the underlying asset at a predetermined price (strike price) before the expiration date. By selling covered calls, the trader generates income, but also limits their potential gains if the asset’s price rises above the strike price.

- The Collar: By combining protective puts and covered calls, the trader creates a collar around their position. This collar limits the potential profit and loss within a certain range of prices. The width of the collar is determined by the strike prices of the options used.

The Protective Collar strategy is often employed when an investor has a bullish outlook on an asset but wants to protect against a potential decline in its price. It allows them to participate in any upward movement while limiting their losses if the price goes down.

- The Protective Collar strategy involves buying protective puts and selling covered calls.

- It creates a collar around the investor’s position, limiting both potential losses and gains.

- The strategy is useful for bullish investors who want to protect against potential price declines.

- One trade-off is the capped potential profit if the price exceeds the strike price of the call option sold.

- By employing the Protective Collar strategy, investors can better manage their risk and protect their investments.

Long Straddle: A Versatile Options Strategy for Trading Volatility

How Does a Long Straddle Work?

A long straddle involves buying both a call option and a put option with the same strike price. This means that the trader is not taking a directional bet on the underlying asset’s price movement, but rather on the volatility of the asset. The strike price is the price at which the option can be exercised, and the expiration date is the date by which the option must be exercised.

By purchasing both a call and a put option, the trader has the potential to profit from a significant price movement in either direction. If the price of the underlying asset moves above the strike price, the call option can be exercised for a profit. On the other hand, if the price moves below the strike price, the put option can be exercised for a profit. In either case, the trader has the opportunity to make gains.

Long Strangle Strategy: Maximizing Profit Potential with Options

Long strangle, allows traders to take advantage of potential price movements in either direction. By purchasing both a call option and a put option with the same expiration date, but different strike prices, traders can position themselves to profit from significant price swings.

Understanding the Long Strangle Strategy

The long strangle strategy involves buying out-of-the-money call and put options simultaneously. An out-of-the-money call option has a strike price above the current stock price, while an out-of-the-money put option has a strike price below the current stock price. By purchasing both options, traders can benefit from a significant price movement in either direction.

Unlike other strategies like the long straddle or the short straddle, the long strangle strategy offers traders the advantage of lower upfront costs. This is because out-of-the-money options are generally cheaper compared to at-the-money or in-the-money options. Therefore, traders can enter into a long strangle position with a relatively small investment.

How the Long Strangle Strategy Works

When a trader executes a long strangle trade, they are essentially betting on significant price movement in either direction. If the stock price moves above the strike price of the call option, the trader can exercise the call option and profit from the price increase. On the other hand, if the stock price drops below the strike price of the put option, the trader can exercise the put option and profit from the price decline.

The long strangle strategy is particularly useful in sideways markets, where the stock price remains within a certain range. In such scenarios, the trader can benefit from the volatility of the stock price without having to predict the direction in which it will move.

Potential Risks and Considerations

While the long strangle strategy has the potential to generate unlimited profits, it is important for traders to carefully consider the risks involved. One major risk is that the stock price may not move significantly in either direction, resulting in the options expiring out-of-the-money and the trader losing their initial investment.

Overall, the long strangle strategy can be an effective tool for traders looking to profit from significant price movements in either direction. By carefully selecting the strike prices and expiration date, traders can position themselves to maximize their profit potential while managing the associated risks.

- Maximize profit potential by purchasing both out-of-the-money call and put options

- Benefit from significant price movements in either direction

- Lower upfront costs compared to other strategies

- Effective in sideways markets with volatility

- Consider potential risks, such as limited time remaining until expiration and the possibility of options expiring out-of-the-money

Exploring the Long Call Butterfly Spread

The Long Call Butterfly Spread involves the purchase of two call options at a lower strike price and the sale of two call options at a higher strike price. By executing this trade, investors are able to create a position that looks like a butterfly on a graph, with the potential for profits to be made if the underlying stock settles at the strike price of the sold options.

The key advantage of the Long Call Butterfly Spread is that it protects investors from large losses in case the stock moves in a direction that is not favorable to their position. By purchasing the lower strike call options and selling the higher strike call options, investors are able to offset potential losses if the stock price moves too far away from their desired strike price.

When executing a Long Call Butterfly Spread, it is important to consider the expiration date of the options contracts. Investors should ensure that the options they are purchasing have enough time until expiration for their market expectations to be realized.

- A Long Call Butterfly Spread involves the purchase and sale of call options

- Investors can use this strategy in bullish or bearish markets

- The position looks like a butterfly on a graph

- It offers limited risk and limited reward

- Protects investors from large losses

- Requires careful consideration of strike prices and expiration dates

FAQ:

What is a Bear Put Spread?

A Bear Put Spread is an options strategy used by traders who expect a moderate decrease in the price of the underlying asset. It involves buying put options at a certain strike price and simultaneously selling the same number of put options at a lower strike price.

What is a Calendar Spread?

A Calendar Spread is an options strategy that involves buying and selling options with the same strike price but different expiration dates. It is used when the trader expects the underlying asset to remain relatively stable in the short term and wants to profit from time decay.

What is a Long Call Butterfly Spread?

A Long Call Butterfly Spread is an options strategy that involves buying two call options at a lower strike price, selling two call options at a higher strike price, and buying one call option at an intermediate strike price. It is used when the trader expects the underlying asset to remain within a certain price range.

What is a Married Put?

A Married Put is an options strategy where an investor buys a put option on a stock they already own. It is used as a form of insurance to protect against a potential decrease in the stock’s price. The put option allows the investor to sell the stock at a predetermined price, limiting their potential losses.