Options Trading: 5 Beginner Strategies

One popular strategy that beginners often consider is buying calls. This involves purchasing the right to buy a specific stock at a predetermined price within a set timeframe. For example, if a consumer expects the shares of a certain company to increase in value, they could buy calls to profit from the potential rise. However, this strategy can be riskier as it requires the stock to rise above the predetermined price to offset the costs.

Another strategy to consider is selling covered calls. This approach involves listing an option to sell a stock that you already own at a higher price within a specific timeframe. By doing so, you can generate income from the premium received for selling the option. However, if the stock price falls, you may be obligated to sell your shares at a lower price, resulting in a potential loss.

For a more conservative approach, you may want to explore buying puts. This strategy allows you to purchase the right to sell a specific stock at a predetermined price within a set timeframe. It can serve as a form of insurance, protecting your investment if the stock price falls. However, it’s important to note that buying puts comes at a cost, which can affect your overall returns.

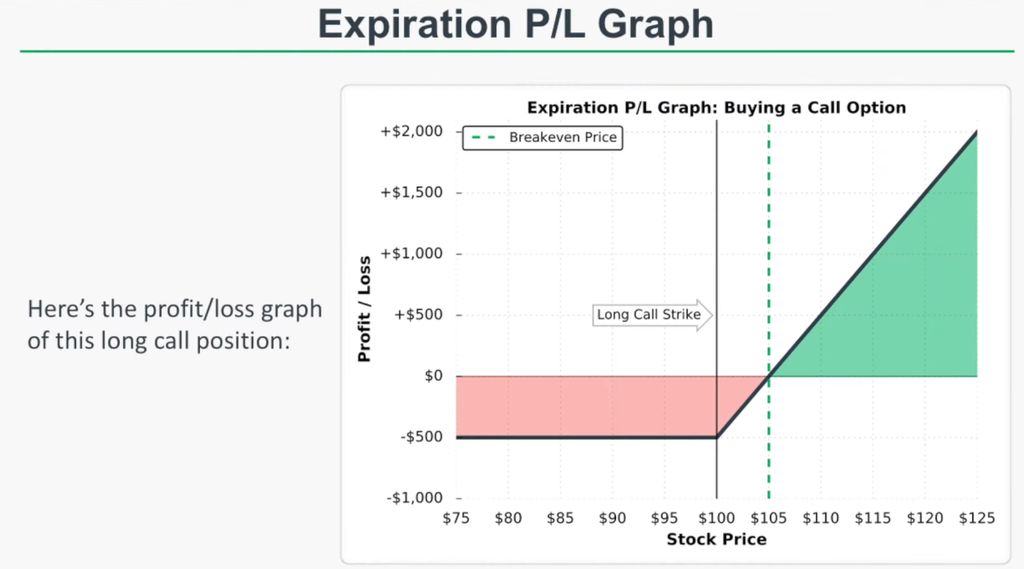

Long Call: A Strategy for Potential Profits in a Rising Market

The long call strategy is a popular option trading strategy that allows investors to potentially profit from a rise in the price of a stock. It involves purchasing a call option, which gives the holder the right, but not the obligation, to buy a specific stock at a predetermined price within a certain timeframe. This strategy is based on the expectation that the price of the underlying stock will increase in the future.

For example, let’s say Professor Johnson expects the stock of XYZ Company to rise in the next few months. He could use the long call strategy to potentially profit from this anticipated increase. By purchasing call options on XYZ Company’s stock, Professor Johnson would have the right to buy the stock at a predetermined price, known as the strike price, if the stock price rises above that level.

The long call strategy is relatively simple and can be a useful tool for investors seeking to benefit from a potential increase in the price of a stock. However, it is important to note that this strategy involves risks. If the stock price does not rise above the strike price before the option expires, the investor could lose the entire cost of the option.

It’s also worth mentioning that the long call strategy can be combined with other options trading strategies to offset some of the risk. For example, an investor could also sell call options at a higher strike price to generate income and reduce the cost of the long call position. This would create a strategy known as a call spread.

When considering the long call strategy, it is essential for investors to carefully assess their risk tolerance and investment goals. Options trading can be riskier than investing in equities, and it is important to fully understand the potential risks and rewards before engaging in options trades.

Covered Call: A Strategy for Generating Income in Binary Options Trading

When it comes to options trading, one strategy that beginners may find useful is the covered call. This strategy allows traders to generate income while minimizing risk by combining the purchase of a stock with the sale of a call option. By doing so, the trader expects to benefit from the premium received from selling the call option, as well as any potential increase in the stock’s price.

In a covered call strategy, the trader first needs to own the underlying stock. This stock represents the “coverage” for the call option that will be sold. The trader is looking to profit from the premium received when selling the call option, which is essentially an agreement to sell the stock at a predetermined price (known as the strike price) within a specified period of time.

By selling the call option, the trader is giving someone else the right to buy the stock at the strike price before the option expires. If the stock price rises above the strike price, the trader may be obligated to sell the stock at a lower price than its current market value. However, the premium received from selling the call option can help offset any potential losses.

It’s important for traders to thoroughly understand the risks and potential impacts of the covered call strategy before implementing it. While it can be a simple and effective way to generate income, it is advised to consult with an expert or do thorough research before engaging in this strategy.

Some experts still strive to make money with this strategy, while others may advise against it. As with any investing strategy, it’s crucial to carefully consider your own financial goals and risk tolerance before deciding whether the covered call strategy is right for you.

Simple Strategy for Binary Options Traders

There are various strategies that beginners can consider. One such strategy is the long put, a technique that enables traders to potentially profit from a decline in the price of an underlying asset. This strategy is based on the trust placed in the market’s ability to generate opportunities for profit, while still considering the potential for loss.

The long put strategy involves purchasing put options, which give traders the right, but not the obligation, to sell a specific number of shares at a predetermined price (known as the strike price) within a specified period of time. By buying put options, traders can benefit from a decline in the price of the underlying asset, as the value of the put options rises when the asset’s price decreases.

Traders using the long put strategy should be advised that there is an initial cost involved in purchasing put options. However, this cost is the total potential loss that traders may face, as the maximum loss is limited to the initial investment. If the price of the underlying asset rises instead of declining, the put options may expire worthless, resulting in a loss of the initial investment.

Short Put

One such strategy known as the “Short Put” option. This feature enables investors to potentially profit from a stock’s rise, fall, or even if it stays the same.

So, what exactly is a short put? In simple terms, it involves selling put options on a stock that you don’t own. By doing so, you enable yourself to potentially profit if the stock price stays above the strike price, or even if it falls slightly.

One example of how a short put can be used is by a trader looking to generate income. Let’s say Brian believes that a particular stock’s price will not fall below a certain level. He can sell put options with a strike price below the current market price. If the stock price remains above the strike price, Brian keeps the premium received from selling the options. However, if the stock price falls below the strike price, Brian may be obligated to buy the shares at the strike price.

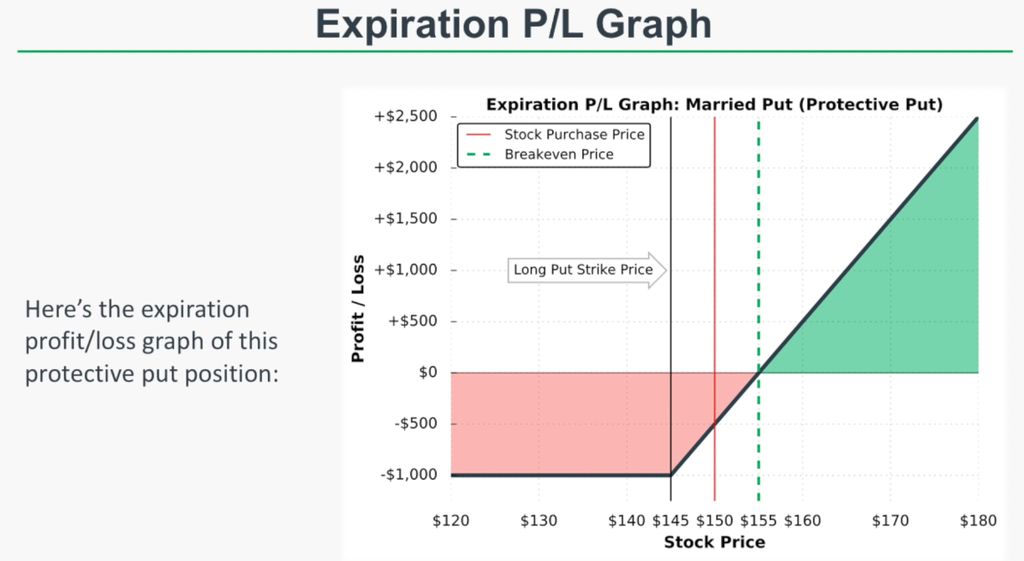

Married Put: A Safer Strategy for Offset Losses

One such strategy is the married put, which offers a safer approach to minimize potential losses. This strategy involves purchasing a put option while simultaneously owning the underlying asset. By doing so, investors can protect their position in case the market experiences a downturn.

In a married put strategy, the investor buys a put option contract for a specific stock or asset. This put option gives the investor the right, but not the obligation, to sell the asset at a predetermined price, known as the strike price, within a specified time frame. The put option acts as an insurance policy, ensuring that losses are limited if the asset’s price drops.

For example, let’s say Brian owns 100 shares of a tech company’s stock, currently valued at $50 per share. Worried about a potential decline in the stock’s price, Brian decides to purchase a put option with a strike price of $45. This put option gives Brian the right to sell his shares at $45, regardless of how low the stock’s price may go.

If the stock’s price were to drop to $40, Brian could exercise his put option and sell his shares at $45, effectively limiting his loss to $5 per share. On the other hand, if the stock’s price were to rise above $45, Brian could simply choose not to exercise the put option and continue holding his shares, allowing him to benefit from any future price appreciation.

The Bankrate Promise: Editorial Disclosure and Integrity

Bankrate’s team of verified writers and experts strive to create content that is trustworthy and reliable. Every article goes through a thorough editorial process to ensure accuracy and clarity. Bankrate wants its readers to always trust the information they find on the platform, whether it’s about options trading or any other financial topic.

Bankrate provides a comprehensive listing of 5 useful strategies for beginners, helping them navigate the complex world of options trading. Whether you are married to a specific strategy or looking to explore different options, Bankrate has got you covered.

Bankrate’s commitment to editorial integrity goes beyond just providing information. It also extends to disclosing any potential conflicts of interest that may arise. For example, if a writer or a member of their immediate family has a financial interest in a specific stock or options, it will be clearly stated in the article.

Bankrate guarantees that its content is based on verified information and the expertise of its team. The platform takes pride in its reputation for providing reliable and accurate financial advice. Bankrate understands that making informed decisions about options trading requires reliable information, and it aims to be the go-to resource for traders looking to enhance their knowledge and skills..

Editorial Disclosure

Editorial disclosure refers to the practice of transparently sharing information about the authors, contributors, and any potential conflicts of interest that may arise in the content presented. It ensures that readers have complete trust in the information provided and can assess its credibility.

When engaging in options trading, it is essential to have access to accurate and reliable information. By understanding the editorial disclosure practices of the platforms, brokers, or financial experts you rely on, you can make more informed decisions about which strategies to implement.

For example, if you are considering using a specific options trading strategy mentioned in this comprehensive guide, you should be aware of any potential conflicts of interest that the author may have. This knowledge allows you to evaluate the information provided in a more objective manner.

Editorial disclosure can also provide insights into the level of expertise and experience of the authors or contributors. Knowing whether they are industry experts, professional traders, or professors in the field can help you determine the credibility and reliability of the information presented.

In addition to the authors and contributors, editorial disclosure may also include information about the platform or broker that offers options trading services. It is important to know whether the platform has any affiliations or partnerships with specific advertisers or companies, as this may impact the recommendations or strategies presented.

| Key Points |

|---|

| Thoroughly research options strategies |

| Create positions that align with your goals |

| Verified information from Johnson & Associates |

| Transparent advertising-supported platform |

| Guidance on costs and how to offset them |

FAQ:

How much money do you need to trade options?

The amount of money needed to trade options can vary depending on various factors such as the price of the options, the number of contracts you want to trade, and the specific strategy you are implementing. In general, it is recommended to have a minimum of $2,000 to $3,000 in your trading account to start trading options. However, it is important to remember that options trading involves risks, and it is advisable to only invest money that you can afford to lose.

How to trade options?

To trade options, you first need to open a brokerage account that offers options trading. Once you have an account, you can then research and analyze various options contracts to identify potential trading opportunities. It is important to understand the basics of options, including the different options strategies and their associated risks. When you are ready to trade, you can place an options trade through your brokerage platform by selecting the desired options contract, specifying the number of contracts and the price you are willing to pay or receive. It is advisable to start with small trades and gradually increase your position size as you gain experience and confidence in your trading abilities.

What is the Bankrate promise?

The Bankrate promise is a commitment made by Bankrate, a financial publishing company, to provide accurate and unbiased information to its readers. Bankrate aims to deliver reliable and trustworthy content that helps individuals make informed financial decisions. The company strives to maintain editorial integrity and transparency by adhering to strict editorial guidelines and ensuring that its content is free from conflicts of interest. The Bankrate promise is a reassurance to readers that they can rely on the information provided by Bankrate to make sound financial choices.